ACA Marketplace

Training & Resources

OEP Starts

11.1.2022

OEP Ends

01.15.2023

Since the ACA ("Obamacare") was enacted in

March 2010, Wise Partners has supported thousands of Marketplace agents and brokers with ACA

Training and Resources.

We've said it many times before: your success is our business. To

be successful, we know that you need access to resources, tools,

training, and marketing support. Take a look at the updates and

resources below to help you navigate your ACA sales journey.

Trending: Commissions & Contracting

Resource Categories

Select a category below to jump to relevant content.

ACA Background &

Updates

Agent Training &

Compliance

Health Sherpa ACA Enrollment Platform

Carrier

Contracting

Carrier Products & Materials

ACA Background & Updates

The Patient Protection and Affordable Care Act, commonly referred to as the ACA or ‘Obamacare’, was enacted in March 2010. The ACA was passed with the goal of lowering the number of uninsured individuals through enrollment in private insurance and the expansion of public insurance coverage (Medicaid). It also looks to increase the quality and affordability of health insurance with subsidies (through “premium tax credits” and “cost-sharing reductions”) and health insurance marketplaces.

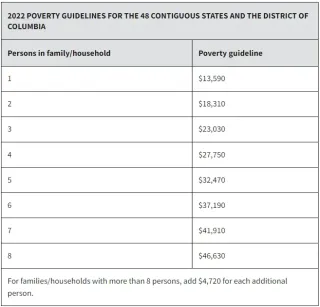

Federal Poverty Guidelines for Plan Year 2023

Marketplace subsidies, including premium tax credits and cost-sharing reductions, are calculated using the prior year's Federal Poverty Level Guidelines. The table below details the 2022 guidelines for the 48 contiguous states and D.C. The guidelines for Hawaii and Alaska are slightly higher, so use the links below the table for additional resources.

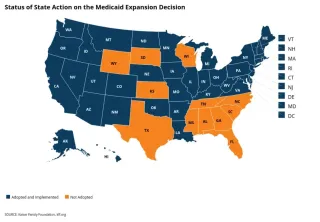

Medicaid Expansion by State

Status of State Action on the Medicaid Expansion Decision

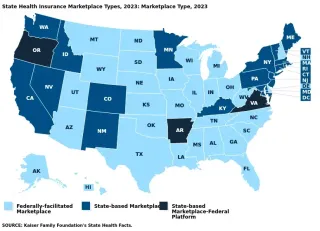

Marketplace Types by State

State Health Insurance Marketplace types 2023,Marketplace types 2023,

Expanded & Enhanced Subsidies Through 2025

Expanded and Enhanced Subsidies Through 2025

Expanded and enhanced marketplace premium subsidies, enacted under the American Rescue Plan Act (ARPA), took effect in 2021 and remain in effect for 2022. The recently passed Inflation Reduction Act (IRA) ensures that the ARPA’s subsidies continue without interruption for an additional three years, through 2025.

Just like the ARPA, the enhanced subsidies in the Inflation Reduction Act reduce costs across the board by further lowering payments for people who were already eligible for subsidies under the original ACA subsidy structure and by extending subsidy eligibility to middle-income people by removing the upper income limit on subsidies.

The subsidy now fully covers the cost of enrolling in the benchmark silver plan for consumers with income up to 150% of the federal poverty level (FPL). With the original ACA subsidy structure, consumers at 150% FPL ($20,385 for a single person in 2023, or $41,625 for a family of 4) had to pay about 4% of household income for the benchmark plan. By reducing premium contributions to $0 (or near $0), the Inflation Reduction Act essentially guarantees access to silver plans with generous cost sharing reductions that substantially reduce deductibles and copays.

The Inflation Reduction Act, like the ARPA before it, extends eligibility for premium tax credits to reach people with incomes over 400% FPL ($54,360 for a single person in 2023, or $111,000 for family of 4). Now these consumers must contribute no more than 8.5% of their income toward the benchmark silver plan. This change is especially beneficial to older marketplace consumers (50 and older) whose premiums are age-adjusted in most states and can be up to 3 times that of young adult premiums for the same policy. The average unsubsidized silver plan premium for a 60-year-old couple in 2023 is more than $1,900 per month in 2023. Under the original ACA subsidy structure, subsidies were unavailable to people with incomes above 400% FPL, meaning premiums for older enrollees could easily cost more than 20% of their household income. But now, premium payments are capped at no more than 8.5% of household income.

Source: Cynthia Cox, Karen Pollitz, Krutika Amin, and Jared Ortaliza, Nine Changes to Watch in ACA Open Enrollment 2023, (KFF, Oct 27, 2022) https://www.kff.org/policy-watch/nine-changes-to-watch-in-open-enrollment-2023/ (10/30/2022).

Family Glitch Fixed

Millions of people now eligible for marketplace subsidies

Until this year, an estimated 5.1 million people were ineligible for marketplace subsidies because of the family glitch. Generally, people are ineligible for marketplace subsidies if they have an offer of “affordable” job-based coverage – including through a family member’s job. However, until 2023, the affordability of job-based coverage for a worker’s spouse and dependents only measured the premium contribution required for the worker’s self-only coverage. As a result, if an employer coverage offer met the affordability threshold (9.12% of income in 2023) for self-only coverage but not for family coverage, those family members were nonetheless considered to have an offer of “affordable” job-based health coverage and locked out of ACA marketplace subsidies.

New rules will take effect for the 2023 coverage year, measuring the affordability of family coverage based on the worker’s premium contribution for family coverage. If that amount is more than 9.12% of household income in 2023, family members will have the option of buying health coverage through the Marketplace and will be eligible for premium tax credits based on their income.

Source: Cynthia Cox, Karen Pollitz, Krutika Amin, and Jared Ortaliza, Nine Changes to Watch in ACA Open Enrollment 2023, (KFF, Oct 27, 2022) https://www.kff.org/policy-watch/nine-changes-to-watch-in-open-enrollment-2023/ (10/30/2022).

Relaxed Rules on Past Due Premium & SEP Verification

Marketplace rules have been relaxed for those who fell behind on premium payments

Until this year, an estimated 5.1 million people were ineligible for marketplace subsidies because of the family glitch. Generally, people are ineligible for marketplace subsidies if they have an offer of “affordable” job-based coverage – including through a family member’s job. However, until 2023, the affordability of job-based coverage for a worker’s spouse and dependents only measured the premium contribution required for the worker’s self-only coverage. As a result, if an employer coverage offer met the affordability threshold (9.12% of income in 2023) for self-only coverage but not for family coverage, those family members were nonetheless considered to have an offer of “affordable” job-based health coverage and locked out of ACA marketplace subsidies.

New rules will take effect for the 2023 coverage year, measuring the affordability of family coverage based on the worker’s premium contribution for family coverage. If that amount is more than 9.12% of household income in 2023, family members will have the option of buying health coverage through the Marketplace and will be eligible for premium tax credits based on their income.

Pre-enrollment verification eliminated except for SEPs due to loss of other coverageOnce Open Enrollment ends, people will continue to be able to sign up for Marketplace coverage mid-year if they have a qualifying life event (such as loss of other coverage, marriage or divorce, or a permanent move) using a 60-day special enrollment period (SEP). In HealthCare.gov states, people had been required to first complete a pre-enrollment verification process by providing documentation of their qualifying event that made them eligible for an SEP. People who could not provide such documentation within 30 days often were denied the SEP.

Starting in 2023, HealthCare.gov will only require pre-enrollment verification for SEPs due to loss of other prior coverage. For other qualifying events (marriage, divorce, permanent move, etc.) people will be able to self-attest to their eligibility and proceed to enroll in coverage during their SEP.

Source: Cynthia Cox, Karen Pollitz, Krutika Amin, and Jared Ortaliza, Nine Changes to Watch in ACA Open Enrollment 2023, (KFF, Oct 27, 2022) https://www.kff.org/policy-watch/nine-changes-to-watch-in-open-enrollment-2023/ (10/30/2022).

ACA Training & Compliance

Licensed agents and brokers may assist consumers

determine their eligibility for insurance affordability

programs, including advance payments of the premium

tax credit and cost-sharing reductions, and enroll them

in qualified health plans (QHPs).

Agents and brokers who wish to assist consumers in the

Individual Marketplace must complete registration and

required training on an annual basis prior to assisting

consumers enroll in a plan.

FFM Training for New and Returning Agents

New Agents & Brokers

New Agents & Brokers Agents and brokers who are new to the Marketplace this year, or who did not complete plan year 2022 registration and training, are required to take the full Individual Marketplace training for plan year 2023. Check out the guide for new agents and brokers to help you through the registration and training steps. When registering your account, select 'MLMS: Marketplace Learning Management System' in the drop-down menu.

Returning Agents & Brokers

Training Link Agents and brokers who completed plan year 2022 Individual Marketplace registration and training will be eligible to take a new half-hour training for plan year 2023, as well as optional review modules. Returning agents and brokers can take Individual Marketplace training either through the Marketplace Learning Management System (MLMS) or the CMS-approved vendor regardless of how they completed the plan year 2022 training. Check out the guide below for returning agents and brokers to help you through the registration and training steps and process.

State-Based Exchange (SBE) Training

Since January 1, 2014, consumers and small businesses in every state (including the District of Columbia) have had access to obtain health insurance coverage through Health Insurance Exchanges operated by States through State-based Exchanges (SBEs), State-based Exchanges on the Federal platform (SBE-FPs), or operated by the Federal government through the Federally-facilitated Marketplace (FFM).

Below is a list of the SBEs along with the state's website link for consumers, agent training links, and any additional notes.

Arkansas (SBE-FP)

my Arkansas Insurance

Agent Training: Initial Assister Licensure requires State Training, a background check, and an exchange application. Renewal Assister Licensure does not require training, but an annual license application is required.

California (SBE)

Covered California

Agent Training: For agency training and certification, start by creating an account through the link below. For individual agents, contact Agility Producer Support for instructions as individuals must certify through an agency.

Colorado (SBE)CO Guide

Connect for Health Colorado

Agent Training: To be certified, you must hold a CO accident & health license, errors & omissions insurance of at least $1M, electronically sign the Producer's Agreement, and complete the online certification coursework. Click the CO Link to get started.

What's My Marketplace (FFM) Registration Status?

Starting with Plan Year 2023, in order to offer Marketplace plans, you must:

Complete FFM Training and sign Agreements ; AND

Have a valid NPN, state license and health-related Line of Authority (LOA)

Here are the steps to check that you have a valid registration with the Marketplace.

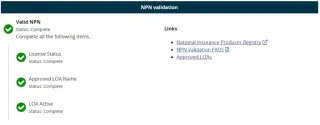

Check your Marketplace Registration Status

MPORTANT: NEW REQUIREMENT!

Verify that your 'Valid NPN' Status is 'Complete'. To be validated, you must have a valid state license, have a valid health-related line of authority (LOA), and have an active status for your health-related LOA.Agents and brokers who do not have an approved health-related LOA, as determined by their resident state, will not be able to access Marketplace systems and will not be able to assist consumers with Marketplace activities for Plan Year 2023.

Your NPN Validation should look like this:

If you do not have a 'Complete' status, proceed to Step 3.

1. If 'License Status' is not Complete, then you must apply for an insurance license in your Resident State.

2. If 'Approved LOA Name' is not Complete, then you likely have a license in your Resident State, but you do not have the correct Line of Authority (for example, you have a Property & Casualty License but not a Health License). In this instance, apply for the correct line of authority in your Resident State.

3.If 'LOA Active' is not Complete, then you have a license with the correct Line of Authority, but you do not have an appointment with a health-related insurance company. In this case, get appointed now by requesting carrier contracting through Agility!

Marketplace Compliance Reminders

Obtain Consent

Obtain consent from each client you work with prior to assisting him or her with Marketplace coverage, including prior to searching for a current application using an approved Classic Direct Enrollment/Enhanced Direct Enrollment website.

Client Accounts

Do not maintain access to a client’s HealthCare.gov account or associated email account.

Never use your own email or mailing address on a consumer's application. Do not create dummy addresses for email or mailing address.

Suspicious Activity

Identify and report suspicious activity or potentially fraudulent behavior you observe in relation to the Marketplace.

This includes concerns that a consumer or another agent or broker has engaged in fraud or abusive conduct.

Accurate Income

Ensure your clients are reporting accurate income when completing or updating the eligibility application. Reinforce that it is in their best interest to report the most accurate income estimate, not the estimate that maximizes the amount of premium tax credit for which they may be eligible

Medicare Eligible

If a client may be eligible for Medicare, direct him or her to Medicare for a determination before you assist that client with enrolling in a Marketplace qualified health plan (QHP).

Protect Information

An agent or broker and any third party with which he or she has entered into a business relationship must adhere to requirements for the use and disclosure of all consumer PII/protected health information (PHI), including all PII/PHI collected by the third party.

ACA Resources by Carrier

We understand that it is difficult to stay up-to-date with carrier plans, coverage areas, and competitive analysis, so we're putting it all in one place.

As information becomes available, we will continue to update this resource page.

Also see our commissions page here:

Ambetter Health

Coverage Maps & Network

Blue Cross and Blue Shield of Illinois

Open Enrollment Readiness Resources for Producers

Blue Cross and Blue Shield of Illinois created an extremely helpful resource tool for agents selling individual ACA health plans: the Open Enrollment Readiness Resources for Producers.

Access all of the tips, tools and training to help you market, sell, renew and enroll.

. Products & Marketing such as Summaries of Benefits, Plan Comparison Charts, Sizzle Sheets, and Customizable Marketing Fliers

. Enrollment Support including the BCSBIL Application Tracker, the Retention Call Center, and Sample Renewal Packets

. The Retail Producer Portal including guides to creating quotes, enrolling and managing clients, and registering for the Portal.

. Premiums & Payments including Initial Payment Information, Pay My Bill Sites, One-time Payment Options, Automatic Payment Authorization Forms, Grace Period Rules, and Pay by Phone info.

. Service & Support including Find a Pharmacy, Prescription Drug Lists, and Pharmacy Programs

Blue Cross and Blue Shield of Montana

Open Enrollment Readiness Resources for Producers

Blue Cross and Blue Shield of Montana created an extremely helpful resource tool for agents selling individual ACA health plans: the Open Enrollment Readiness Resources for Producers.

Access all of the tips, tools and training to help you market, sell, renew and enroll.

. Products & Marketing such as Summaries of Benefits, Plan Comparison Charts, Sizzle Sheets, and Customizable Marketing Fliers

. Enrollment Support including the BCSBIL Application Tracker, the Retention Call Center, and Sample Renewal Packets

. The Retail Producer Portal including guides to creating quotes, enrolling and managing clients, and registering for the Portal.

. Premiums & Payments including Initial Payment Information, Pay My Bill Sites, One-time Payment Options, Automatic Payment Authorization Forms, Grace Period Rules, and Pay by Phone info.

. Service & Support including Find a Pharmacy, Prescription Drug Lists, and Pharmacy Programs

Blue Cross and Blue Shield of New Mexico

Open Enrollment Readiness Resources for Producers

Blue Cross and Blue Shield of Mexico created an extremely helpful resource tool for agents selling individual ACA health plans: the Open Enrollment Readiness Resources for Producers.

Access all of the tips, tools and training to help you market, sell, renew and enroll.

. Products & Marketing such as Summaries of Benefits, Plan Comparison Charts, Sizzle Sheets, and Customizable Marketing Fliers

. Enrollment Support including the BCSBIL Application Tracker, the Retention Call Center, and Sample Renewal Packets

. The Retail Producer Portal including guides to creating quotes, enrolling and managing clients, and registering for the Portal.

. Premiums & Payments including Initial Payment Information, Pay My Bill Sites, One-time Payment Options, Automatic Payment Authorization Forms, Grace Period Rules, and Pay by Phone info.

. Service & Support including Find a Pharmacy, Prescription Drug Lists, and Pharmacy Programs

Blue Cross and Blue Shield of Oklahoma

Open Enrollment Readiness Resources for Producers

Blue Cross and Blue Shield of Oklahoma created an extremely helpful resource tool for agents selling individual ACA health plans: the Open Enrollment Readiness Resources for Producers.

Access all of the tips, tools and training to help you market, sell, renew and enroll.

. Products & Marketing such as Summaries of Benefits, Plan Comparison Charts, Sizzle Sheets, and Customizable Marketing Fliers

. Enrollment Support including the BCSBIL Application Tracker, the Retention Call Center, and Sample Renewal Packets

. The Retail Producer Portal including guides to creating quotes, enrolling and managing clients, and registering for the Portal.

. Premiums & Payments including Initial Payment Information, Pay My Bill Sites, One-time Payment Options, Automatic Payment Authorization Forms, Grace Period Rules, and Pay by Phone info.

. Service & Support including Find a Pharmacy, Prescription Drug Lists, and Pharmacy Programs

Blue Cross and Blue Shield of Texas

Open Enrollment Readiness Resources for Producers

Blue Cross and Blue Shield of Texas created an extremely helpful resource tool for agents selling individual ACA health plans: the Open Enrollment Readiness Resources for Producers.

Access all of the tips, tools and training to help you market, sell, renew and enroll.

. Products & Marketing such as Summaries of Benefits, Plan Comparison Charts, Sizzle Sheets, and Customizable Marketing Fliers

. Enrollment Support including the BCSBIL Application Tracker, the Retention Call Center, and Sample Renewal Packets

. The Retail Producer Portal including guides to creating quotes, enrolling and managing clients, and registering for the Portal.

. Premiums & Payments including Initial Payment Information, Pay My Bill Sites, One-time Payment Options, Automatic Payment Authorization Forms, Grace Period Rules, and Pay by Phone info.

. Service & Support including Find a Pharmacy, Prescription Drug Lists, and Pharmacy Programs

HealthSherpa for ACA Enrollment

Wise Partners has partnered with Health Sherpa, an innovative healthcare technology and the country's largest ACA agent enrollment platform. Use Join Code b4fd to get started for free today!

Enhanced Direct Enrollment (EDE)

With Health Sherpa's faster and easier alternative to Healthcare.gov, you'll have the leading-edge technology you need to maximize your Marketplace experience.

Sign up for your free HealthSherpa Agent Account with Join Code b4fd

Process enrollments and renewals, manage leads and strengthen your overall business with the power of HealthSherpa's Agent Tools behind you.

More HealthSherpa Video Resources

Start Your ACA Contracting!

Complete the form and we will guide you through our simple, short and sweet ACA contracting and on-boarding process.

Agent and Broker contracting at it's finest!

Bilingual Support

Training Events & Live Webinars

MyAdmin Personalized Back Office

Print & Digital Marketing Material

Top Insurance Carrier Contracting

MGA and GA Contracts Available

Wise Partners Blog

Get even more info on resources, news and bonuses, etc.

Use our blog to search and find up-to-date resources, carrier bonuses, market expansions, news, trending topics and so much more.

Select Carriers & Complete the Form:

Agency Information (if applicable)

© 2017 - 2022 Wise Partners Services, LLC. All Rights Reserved. This site is for agent use only. Not affiliated with the United States government or the federal Medicare program. Not all products are available in all areas. Exclusions and limitations may apply.

Carriers | Contracting | Privacy Policy

Houston, TX